sacramento county tax rate

The current total local sales tax rate in Sacramento County CA is 7750. View the E-Prop-Tax page for more information.

California Taxpayers Association California Tax Facts

A county-wide sales tax rate of 025 is.

. Those district tax rates range from 010 to 100. This is the total of state and county sales tax rates. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Postal Service postmark Contact Information. How much is the documentary transfer tax.

You can find more tax rates and allowances for Sacramento County and California in. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. The minimum combined 2022 sales tax rate for Sacramento California is.

Learn all about Sacramento County real estate tax. Carlos Valencia Assistant Tax Collector. 1788 rows Sacramento.

Has impacted many state nexus laws and sales tax collection requirements. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The minimum combined 2020 sales tax rate for Sacramento California is 875.

The December 2020 total local sales tax rate was also 7750. County of Sacramento Tax Collection and Business Licensing Division. The Sacramento County California Local Sales Tax Rate is a minimum of 625 What is the sales tax in Roseville CA.

Ad Find Sacramento County Online Property Taxes Info From 2021. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. You can print a 875 sales tax table here.

Monday Friday from 900am to 400pm. Unsure Of The Value Of Your Property. With market values established Sacramento along with other county governing districts will determine tax rates independently.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The 2018 United States Supreme Court decision in South Dakota v. Sellers are required to report and pay the applicable district taxes for their taxable.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. This is the total of state county and city sales tax rates.

700 H St 1710 Sacramento CA 95814 916 874-6622. Some areas may have more than one district tax in effect. Sacramento Property Tax Rates.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. 2021-22 Sacramento County Property Assessment Roll Tops 199 Billion.

For tax rates in other cities see California sales taxes by city and. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state sales. The December 2020 total local sales tax rate was also 8750.

Did South Dakota v. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax.

This is primarily a budgetary exercise with entity managers first estimating yearly spending targets. Roseville California Sales Tax Rate 2021 The 775 sales tax rate in Roseville consists of 6 California state sales tax 025 Placer County sales tax 05 Roseville tax and 1 Special tax. Property information and maps are available for review using the Parcel Viewer Application.

Whether you are already a resident or just considering moving to Sacramento County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Tax Collection and Licensing. After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate of your supplemental tax.

By clicking Accept you agree to the terms of the. A composite rate will generate counted on total tax revenues and also reflect each taxpayers bills amount. T he tax rate is.

The current total local sales tax rate in Sacramento CA is 8750. What is the sales tax rate in Sacramento California. To review the rules in California visit our state-by-state guide.

A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

The Sacramento sales tax rate is. How much is county transfer tax in Sacramento County. T he tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

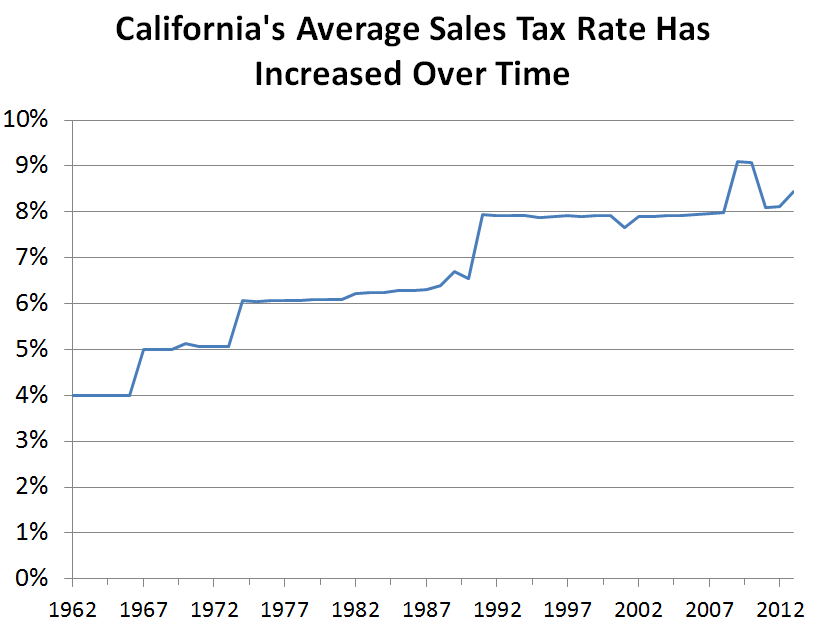

The California state sales tax rate is currently 6. The statewide tax rate is 725. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value.

2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. The Sacramento County sales tax rate is 025. The County sales tax rate is.

Each TRA is assigned a six-digit numeric identifier referred to as a TRA number. This is the total of state county and city sales tax rates. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division.

Find All The Record Information You Need Here. TaxSecured saccountygov FAQ. 36 rows The Sacramento County Sales Tax is 025.

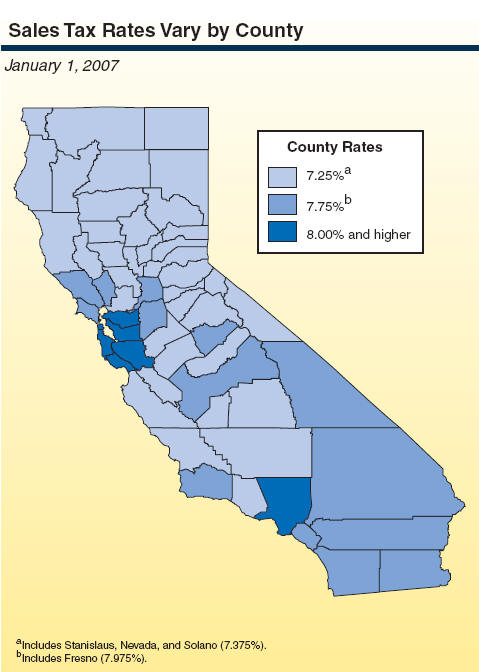

The California sales tax rate is currently. Tax Rate Areas Sacramento County 2022. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

Compilation of Tax Rates by Code Area.

Sacramento County Ca The Bishop Real Estate Group

Amazon Com Sacramento County California Zip Codes 36 X 48 Laminated Wall Map Office Products

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

Sacramento County Zip Code Map Otto Maps

California S Sales Tax Rate Has Grown Over Time Econtax Blog

Sales Tax Rates Finance Business

All About California Sales Tax Smartasset

Understanding California S Sales Tax

Understanding California S Property Taxes

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

California Sales Tax Rates Vary By City And County Econtax Blog

Sacramento County Transfer Tax Who Pays What

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

The Property Tax Inheritance Exclusion

Sacramento County Transfer Tax Who Pays What